How to Read A Credit Report

because knowledge is power

Consumer reports (aka credit reports) can feel like a secret code—and that’s exactly why so many errors go unnoticed. The fine print, abbreviations, and confusing layouts make it hard to spot mistakes that could damage your credit score, cost you a loan, or even block you from getting a job. Knowing how to read a credit report can prevent losses and safeguard your financial future.

✨ Pro Tip: Don’t stop with the Big Three. If you’ve been denied housing, insurance, or a job, ask which specialty reporting agency was used. Errors there can be just as damaging—and often go unchecked until you dig deeper. Once you learn the basics of how to read a credit report, it will translate to most types of consumer reports.

This guide walks you through the four major parts of a credit report so you know how to read a credit report—and why it matters. We focus on the Big Three bureaus (Experian, Equifax, and TransUnion), but remember: there are hundreds of specialty consumer reporting agencies that collect and sell your data too. If you’re holding a report you don’t understand, contact an experienced credit reporting attorney at Wells Law – Chicago—we’ll help you make sense of it so you know how to read a credit report in your unique situation and understand your options.

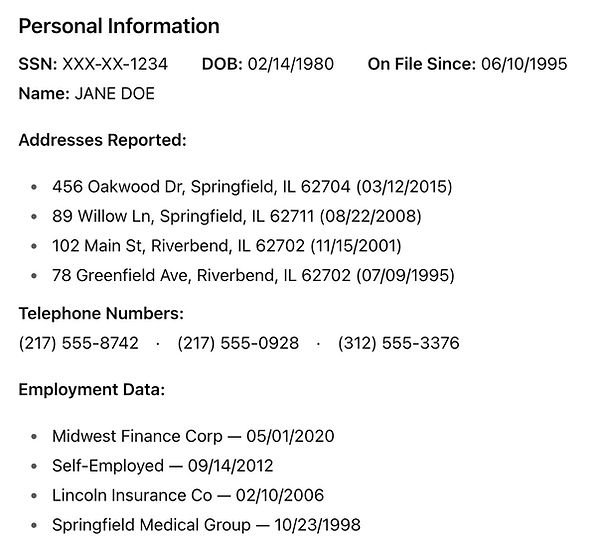

Section 1: Personal Information

How to Read a Credit Report |

This includes identification, as well as current and past addresses. This data comes from the information given to creditors.

➡ What to Look For:

-

Names that don’t belong to you (variations or completely wrong identities)

-

Addresses you never lived at

-

Incorrect Social Security digits

❗ Why It Matters:

Errors here may signal identity theft or a mixed file—when someone else’s information gets blended with yours. These mistakes can snowball, showing up across accounts and public records, making it critical to catch them early.

2: Public Records

How to Read a Credit Report |

This is data collected from court records and is viewed negatively by lenders. This section includes bankruptcies. Other public records for civil judgments and tax liens that may not show on credit reports could appear in other types of consumer reports.

➡ What to Look For:

-

Bankruptcies, judgments, or liens that aren’t yours

-

Outdated bankruptcies still on your report (usually 7 - 10 years)

-

Duplicate records for the same event

❗ Why It Matters:

Public records carry enormous weight in credit scoring. Even one incorrect record can drag down your score, inflate your interest rates, or cause loan denials—sometimes for years. The FCRA gives you the right to dispute these inaccuracies and demand corrections.

How to Read a Credit Report |

Section 3: Account Information

This includes both satisfactory accounts, and adverse accounts. The latter is generally where problems are found. However, even satisfactory accounts may be tell-tale signs that your file is mixed with another consumer.

Adverse accounts show lines of credit that have not been paid, have missed or late payments, were sent to a collection agency, or were “charged off” meaning that the company reported the debt as lost income and may have sold the debt to a collection agency. A history of late payments lowers your credit score, especially if it’s more recent. Many lenders will not offer credit until overdue debts have been paid.

➡ What to Look For:

-

Accounts you don’t recognize (possible fraud or reporting error)

-

Incorrect balances, late-payment histories, or wrong credit limits

-

Negative accounts that should have “aged off” (most drop after seven years)

❗ Why It Matters:

This section is the heart of your credit report. Lenders rely on it heavily when deciding whether to approve you for credit cards, car loans, or mortgages. An error here can cost you thousands of dollars in interest—or an opportunity altogether.

How to Read a Credit Report |

Section 4: Inquiries

There are a variety of types of inquiries that may appear on your report. Account review and promotional inquiries (a.k.a. "soft inquiries"are not seen by third-parties and do not affect your credit score.

Regular inquiries, or "hard inquiries" do impact you. When you apply for credit or buy insurance, for example, the lender reviews your credit report for a positive history and credit worthiness. These inquiries stay on a report for 2 years and can be seen by all creditors who look up your report. Hard inquiries can drop a credit score by 5-20 points for many months.

➡ What to Look For:

-

Companies you never applied with

-

Multiple inquiries for the same loan application

-

Old inquiries that should no longer appear

❗ Why It Matters:

Every time someone pulls your credit, it leaves a mark. Too many inquiries can lower your score, while unauthorized pulls may violate the Fair Credit Reporting Act. Spotting and challenging them is key to protecting your financial reputation.

Find errors or problems in your consumer report?

Contact Wells Law - Chicago today.